Table of Content

Whether you just bought a home or have owned your home for some time, there are many things you can do to save money for years to come. A below-market interest rate is an interest rate lower than that currently being offered for commercial loans extended by banks. A home mortgage is a loan given by a bank, mortgage company, or other financial institution for the purchase of a primary or investment residence.

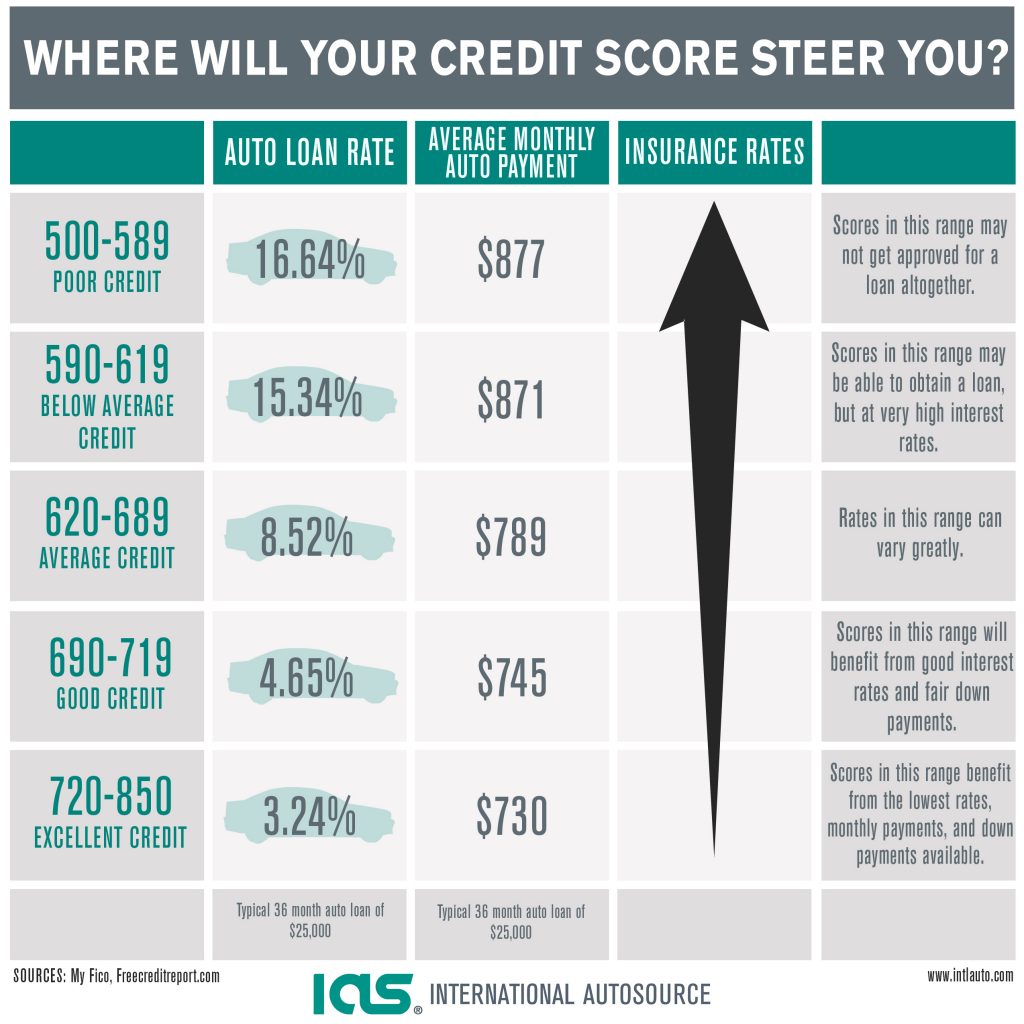

FHA loans let you put down as little as 3.5% if you have a credit score of 580 or higher. However, you may still be able to get a loan with a credit score of at least 500 — but you’ll likely need to make a 10% down payment. FHA loans also require you to pay a mortgage insurance premium. For instance, you may offer to put more toward your down payment, which reduces the size of the mortgage you need — and the lender’s risk.

Establish an alternative payment history

And though she finds the color orange unflattering on most people, she thinks they'll enjoy Champaign tremendously. The amount of credit you are currently using is also known as your credit utilization and is responsible for 30% of your score. The more credit you’re using, the higher your credit utilization, the lower your score can become.

It requires home buyers to have a minimum credit score of 580 at the time of purchase. Mortgage lenders look at the “age,” dollar amount, and payment history of your different credit lines. That means opening accounts frequently, running up your balances, and paying on time or not at all can impact your credit score negatively. Just changing one of these components of your spending behavior can positively affect your credit score. This means people without any credit history, such as teenagers or new immigrants, may be able to take advantage of these plans. It also means people who have maxed out their credit cards can also participate.About three-quarters of all applicants are approvedalmost immediately.

Why You Should Improve Your Credit Score Before Buying

This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. As a first-time home buyer, you generally have less life experience than a person who has previously owned homes.

Except, as a first-time home buyer, you have no recent mortgage payment history. Because a credit score of 500 is required to get mortgage-approved, only 5% of U.S. consumers would be mortgage-ineligible based on their credit score alone. The reality, though, is that you don’t need a high credit score to get home loan-approved — and your rates can still be great. The owner will keep the title until you refinance the house a few years later and the title is turned over to your new mortgage lender. One fact that makes credit scores a bit confusing is that there are so many of them. These numbers are generated by credit scoring agencies and financial institutions.

Good loan programs for buyers with bad credit

Not only is it attractive for borrowers who have a lower credit score, but you only need a 3.5% down payment. The federal government insures Government-backed loans, and with less of a risk to the lender, they have low requirements for the downpayment and your debt to income ratio. If you have poor credit but a lot of cash saved up, some mortgage lenders might be willing to approve you for a home loan if you make a larger down payment. The eligibility requirements, credit standards, and down payment of these types of home-ownership programs will vary from owner to owner. There are many ways someone can still buy a home with bad credit and little to no cash on hand.

All you need to do is make sure you make all payments on time and pay off your other debts. After you have increased your credit score, you may have the opportunity to refinance your home and obtain a lower interest rate and payment. First-time home buyers tend to have lower credit scores than the general population, and that’s okay. There are plenty of mortgage programs meant to help first-time buyers move into homeownership. There’s a large selection of mortgage loans geared toward first-time home buyers, and which allow for lower credit scores.

Five ways to buy a house with a lower credit score

Additionally, you can sign up for a credit monitoring service that will provide you with a 3-bureau report and your credit scores. Don’t worry, pulling your own credit with these types of services do not have an impact on your credit scores. A VA loan is a loan designed for veterans who have qualified for a Certificate of Eligibility and meet their mortgage lender’s eligibility requirements. Many lenders work with VA loans to get you approved for little to no money down. Some lenders may even pay your closing costs so that you get into your home with as little up-front investment as possible.

If you're interested in buying a home in a qualifying rural area with no down payment, a USDA loan makes it possible with a score in the 640 range. FHA home loans are backed by the Federal Housing Administration and typically require a credit score of around 580. However, if you can make a 10% down payment, you may be approved with a score as low as 500. About 90% of these loans are tied to a debit card, which means the payments are automatically deducted from the borrower’s bank account. So when someone misses a payment, it’s likely because there were insufficient funds in their account. Besides the late fee, these borrowers will also end up getting charged an overdraft fee.

Lenders view applicants with bad credit as a risk, and charging a higher interest rate helps mitigate the risk. Most borrowers don’t know this, but many lenders don’t require a specific minimum credit score to buy a house. The catch-22 is that a conventional mortgage lender is free to set their own requirements when it comes to your credit score. Although government-backed loans give mortgage lenders some peace of mind, they still have credit score requirements, even if they are usually much lower. This rule helps explain why most conventional loans have credit score minimums in the 600s. While these loans tend to have higher interest rates, they are much more accessible for borrowers who are buying with bad credit.

If this will help your credit score, you should ask to have this agreement made in writing so you can make sure it is removed when you pay. In order to get stellar credit, it will make sense to work on this aspect of your finances. By keeping your credit card debt low, you can really improve your scores. If you have a high credit score, you will have more options for a mortgage.

No comments:

Post a Comment